Recent data from Zoopla show that the North West’s housing market is one of the best in the UK right now, with the highest annual change in house prices in England. The January 2024 index published last month shows that houses in the region have increased by 0.7% compared to last year. Although the annual house price change is not particularly high, it’s somewhat promising for the property market in the North West given that the UK as a whole saw a decrease of 0.5%.

This growth appears to be part of what we’re seeing as the North-South divide when it comes to property market growth. Overall, the four regions in the North (North West, North East, Yorkshire and Humberlands) saw varying degrees of growth, whereas other regions located in the South (East of England, London, South East and South West) saw a decline. Meanwhile the midlands saw growth in the West but a decline in the East.

| North | South |

| North West (0.7%) | East of England (-2.1%) |

| North East (0.6%) | London (-0.8%) |

| Yorkshire and Humber (0.3%) | South East (-1.9%) |

| South West (-1.7%) |

The findings were based on Zoopla’s House Price Index (HPI), which uses a repeat sales-based price index, which takes into account sold prices, mortgage valuations and recently agreed sales. The annual growth changes aren’t enormous by any means, all falling within approximately 2% of change either way. However, it is interesting to look at how England is split into which property markets appear to be on the right trajectory and which aren’t looking as promising.

Last year, the North also outperformed the South in terms of annual house price growth. Looking back to May 2023, the North had an annual increase of 2.7%, with house prices rising from £205,.875 in 2022 to £211,392 on average. In the South this rise was only 0.8%, with 2022 house prices growing from £385,719 to £388,917 in 2023. In fact, Liverpool was named fastest city to sell a home at the end of 2022. But 2024 is hitting differently, as the property market in the South is in decline, along with the UK average. These findings really reverse the whole portrayal of a booming property market in the South and struggling property market in the North.

Several factors might explain this North-South housing market divide.

One of the main theories is the move away from London to other top cities in the UK. London has become far too expensive for most, and so Manchester, Liverpool, Newcastle and other cities north of the capital are more appealing. London’s high cost of living, particularly in terms of housing and general expenses, has become prohibitively expensive for many. The city’s property prices and rents are among the highest in the country, making it increasingly difficult for average earners, especially young professionals and families, to afford living there.

Northern properties are not only more affordable, but also generate better return on investments. Therefore, investing in the North has become more attractive. When looking deeper into the HPI data, we can see the cities that are performing the best. In England, Liverpool had the highest growth at 1.1%, followed by Manchester, Leeds and Newcastle at 0.8%, and Sheffield at 0.7%. If we think about some of those cities, we can see that many have had huge interest from investors and developers in recent years.

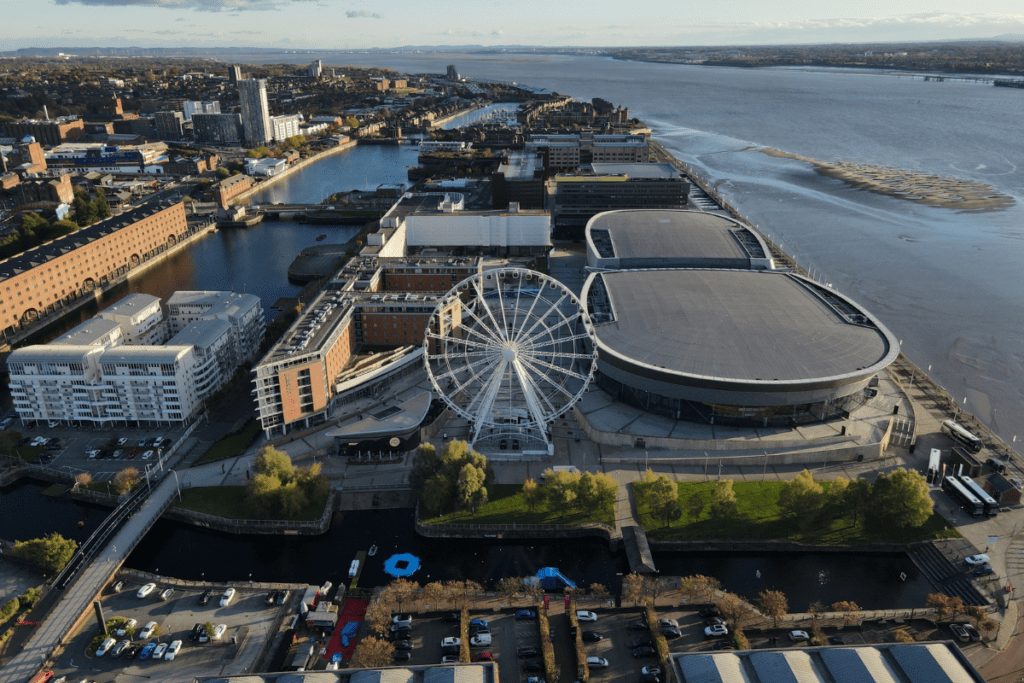

Liverpool has undergone a remarkable transformation, particularly through the Liverpool Waters project. This development has revitalised a substantial portion of the city, enhancing its appeal to students, professionals, tourists, and residents alike. Its longstanding reputation as a prime location for property investment and buy-to-let landlords is bolstered by high rental yields and a consistent ability to maintain property values above the national average.Similarly, Manchester is experiencing substantial urban renewal through various regeneration initiatives. The city holds a perennial charm, especially among students and young professionals, which fuels a robust demand in its rental market. With predictions of continued population growth, Manchester remains a highly attractive destination for property investors who are focused on the long-term potential of a locale. These two cities in the North West perhaps explain why the property market is the fastest growing in England.

Another possible reason is that mortgage repayment rates are significantly less in the North compared to the South. In recent years, we’ve seen absolute chaos and unprecedented levels when it comes to mortgage rates, so it’s likely the South was hit harder than the North.

What does the future look like?

It’s always difficult to say what will happen with the property market this year – particularly given the recent turbulence observed. However, I anticipate that the North-South divide will continue to appear. People simply can’t afford the high house prices and high mortgage repayment rates in the South, making cities in the North – in particular the North West – much more attractive to new first-time homebuyers, investors, landlords and renters.

Property valuations in the North

Are you curious about the value of your property in the thriving markets of Manchester or Liverpool? With the dynamic shift in the UK’s property landscape, you might be thinking about selling or at least exploring the potential of your investment. Whether you’re considering selling, renting, or simply evaluating your assets, understanding the current value of your property is crucial in these rapidly evolving cities.

A RICS valuation provides a reliable and professional estimation of your property’s worth, conducted by experts familiar with and local to Manchester and Liverpool. This service is not only beneficial for those looking to sell but also for homeowners considering refinancing options or assessing their property’s value for other financial purposes.